Hi there, I’m Melanie Lopez from Boston, and welcome to my new website, American National Car Insurance. If you have been wondering why car insurance premiums in the USA have been soaring lately, you’re not alone.

This is a topic that affects millions of Americans, and it’s time we unpack the real reasons behind these skyrocketing rates.

This article explains why car insurance costs are rising. I will share practical tips and personal examples to help you. You’ll also find tables, FAQs, and useful advice to guide you through this tough situation

The Current Trends

If you’ve noticed your auto insurance bills climbing, you’re not imagining it. According to the latest data, car insurance rates in the USA have risen by over 17% on average since 2022

In some states like Florida, California, and Michigan the increase has been even sharper.

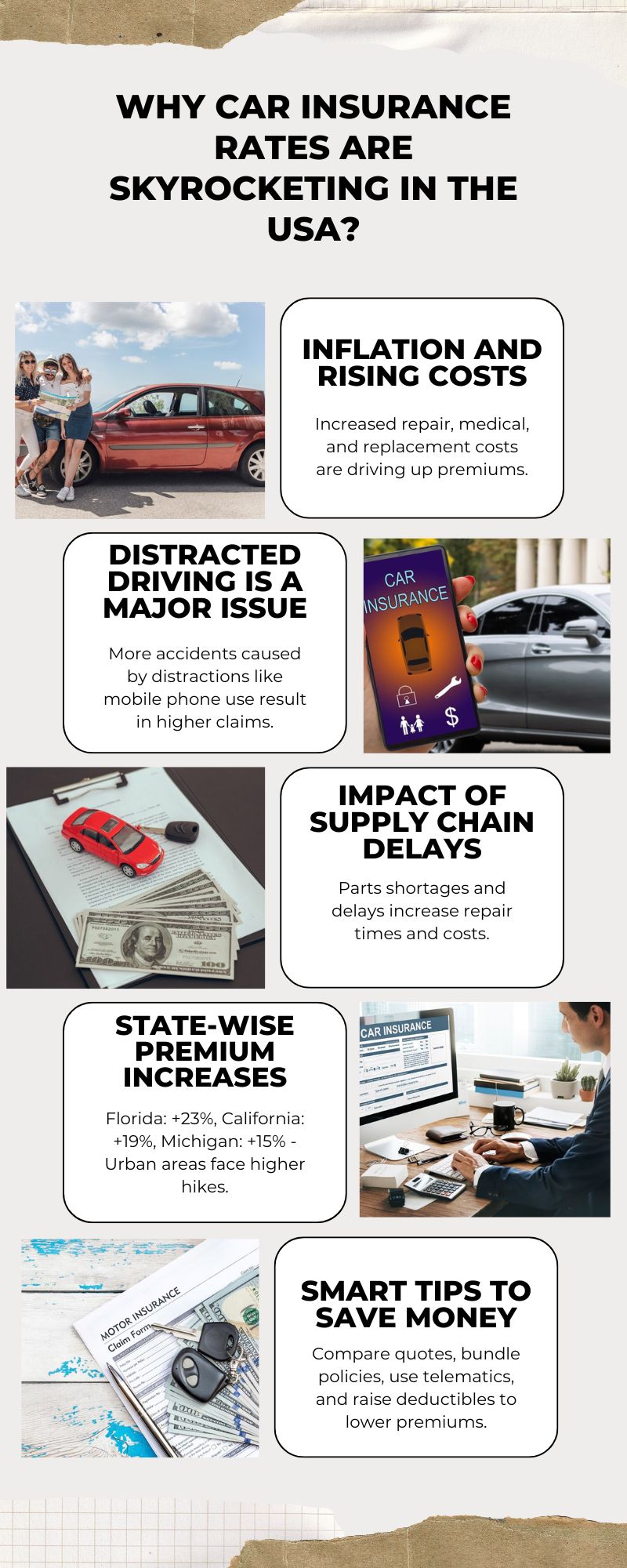

Key Drivers of the Rising Insurance Costs

- Inflation– Everyday items are more expensive, and so is car insurance. Inflation has hit repair costs, medical bills, and even car rentals, which all play into premium calculations

- Increased Accidents– Distracted driving, speeding, and reckless behavior have caused accident rates to rise leading to higher claims for insurers

- Supply Chain Challenges– A shortage of car parts and delays in vehicle repairs have made claims more expensive to settle.

| State | Average Premium Increase (2023-2024) |

| Florida | 23% |

| California | 19% |

| Michigan | 15% |

Factors That Insurers Consider

Knowing how insurers set premiums helps you choose wisely. Although each company may have slight differences, they all consider these key factors

1. Your Driving History

Your record on the road plays a huge role. Drivers with a history of speeding tickets or accidents are likely to pay more

2. Credit Score

Believe it or not, your credit score affects your premium. Insurers use it as a risk indicator, even if you have a perfect driving record

3. Location

Where you live matters. Urban areas typically have higher rates due to more traffic and thefts

4. Car Model

The type of vehicle you drive impacts your insurance rate. Expensive cars or those prone to theft cost more to insure.

| Factor | Impact on Premiums |

| Good Driving Record | Lowers Premiums |

| Poor Credit Score | Increases Premiums |

| Urban Residence | Higher Premiums |

| Luxury Cars | Significantly Higher Premiums |

Stories From Real Drivers

To bring this closer to home, let me share a story about Sarah, a friend of mine from Boston. Sarah drives a Toyota Camry, and she’s been with the same insurer for five years. In 2022, her six-month premium was $500. By late 2023, it jumped to $800. She was shocked.

Sarah has a clean driving record, so why the spike? Her insurer explained it was due to inflation and higher claims in her area. She shopped around, found a better rate, and switched insurers.

If you’re in a similar situation, don’t hesitate to compare options. Many drivers like Sarah save hundreds by exploring alternatives.

How To Save Money

Now that we know what’s driving these increases, let’s talk about what you can do. Here are some practical tips:

- Shop Around for Quotes

Don’t settle for the first quote. Use comparison tools to check rates across multiple insurers - Raise Your Deductible

Increasing your deductible can lower your monthly premium. Just make sure you can afford it if you need to file a claim - Take Advantage of Discounts

Unlock savings with insurers who reward smart choices. Bundle your policies for extra discounts. Drive safely and watch your premiums plummet. Install safety features in your car to reap even greater rewards - Use a Usage-Based Insurance Program

If you drive less programs like Progressive’s Snapshot can reward you with lower premiums

| Money-Saving Tip | Potential Savings |

| Shopping Around | Up to 25% |

| Raising Deductible | 10%-15% |

| Bundling Policies | 5%-20% |

What Experts Are Saying

Experts agree that this trend isn’t going away soon. In fact, some believe rates could rise another 5%-10% in 2025. Why? The economy and driving habits aren’t improving fast enough to offset costs.

The Insurance Information Institute says claims from distracted driving are up 12% in the last year

What The Future Holds

The future of auto insurance might feature personalised pricing. For instance, some insurers are now investing in telematics devices to monitor driving. These devices could lower premiums for safe drivers. However, they may penalise risky behaviour.

| Future Trend | Potential Impact |

| Telematics Pricing | Rewards Safe Driving |

| Digital Claims Processing | Faster Settlements |

| AI-Powered Risk Analysis | More Accurate Premiums |

FAQ : Why Car Insurance Rates Are Skyrocketing In The USA

What makes car insurance rates increase so much?

The main reasons are inflation, increased accident rates. Higher repair costs due to supply chain issues is also a reason

Can I lower my car insurance premium?

Yes shopping around, increasing your deductible, and taking advantage of discounts can help

Are all states seeing the same rise in premiums?

States like Florida and California are riding the wave of rising costs. Local factors, such as accident rates and litigation expenses, fuel this surge. These elements combine, creating a perfect storm for higher increases

How does my credit score affect my car insurance?

Insurers use credit scores as a measure of risk. A lower score often means a higher premium, even if your driving record is clean

Final Thoughts: Why Car Insurance Rates Are Skyrocketing In The USA

Rising car insurance rates in the USA are a challenge we can’t ignore. But with the right strategies, you can manage these costs effectively. Don’t hesitate to shop around, explore discounts, and stay informed.

If you found this article helpful, please share it. Also, subscribe to our website for updates

Melanie Lopez is a passionate content specialist at American National Car Insurance, dedicated to simplifying car insurance for every American driver. With years of industry expertise, she crafts informative and engaging articles to help users make confident insurance decisions.