Car insurance is a crucial aspect of financial planning for vehicle owners in the United States. Navigating the options can be overwhelming, especially with so many companies offering competitive rates and varied benefits.

As Melanie Lopez from Boston, I’ve analyzed and compiled detailed insights into the best USA car insurance options for 2025. Let’s explore these options together to help you make an informed decision.

The Secret to Getting the Best USA Car Insurance – Large Companies

When it comes to large car insurance providers, State Farm emerges as the top choice. Why? State Farm offers affordable rates for good drivers. According to recent analyses of minimum coverage rates, State Farm’s average annual rate is $471, or about $39 per month. Additionally, the company has earned a five-star rating for its stellar customer service.

Key Highlights of State Farm:

- Affordable rates for good drivers.

- High customer satisfaction.

- Robust coverage options.

Table: Features of State Farm

| Feature | Detail |

| Average Annual Rate | $471 |

| Monthly Cost | $39 |

| Customer Satisfaction | 5-star rating |

The Secret to Getting the Best USA Car Insurance – Midsize Companies

For midsize car insurance providers, American National stands out. It’s known for its unique benefits, including cash-back rewards for claim-free drivers.

Pros of American National:

- Cash-back rewards after three claim-free years.

- Available in all 50 states and Puerto Rico.

- Low number of customer complaints.

Cons:

- Limited discounts available.

- Website lacks detailed information.

Table: Benefits of American National

| Feature | Detail |

| Claim-Free Rewards | Cash-back after 3 years |

| Coverage Area | 50 states + Puerto Rico |

| Customer Complaints | Low |

The Secret to Getting the Best USA Car Insurance – After a Speeding Ticket

Speeding tickets can significantly affect your insurance rates. However, State Farm offers competitive options even after a speeding violation. It provides discounts for safe driving and young drivers, along with comprehensive coverage for rental cars and travel expenses.

Pros of State Farm for Speeding Tickets:

- Safe driving programs.

- Discounts for young drivers.

- Excellent travel expense coverage.

Table: State Farm for Speeding Tickets

| Feature | Detail |

| Discounts | Safe driving, young drivers |

| Rental Car Coverage | Included |

| Customer Satisfaction | High |

The Secret to Getting the Best USA Car Insurance – After an Accident

After an accident, State Farm remains a top choice due to its affordable rates and comprehensive coverage. With generous claim options and reliable customer support, it’s a dependable partner for recovering from accidents.

Table: State Farm After an Accident

| Feature | Detail |

| Claim Options | Generous |

| Customer Support | Reliable |

| Affordability | High |

The Secret to Getting the Best USA Car Insurance – After a DUI

If you’ve faced a DUI charge, Progressive offers valuable coverage options. Progressive provides accident forgiveness programs and ride-share coverage, making it a viable choice for those with DUI records.

Pros of Progressive:

- Accident forgiveness programs.

- Ride-share coverage available.

- Pet injury coverage in collision accidents.

Cons:

- Below-average claim satisfaction.

- Limited availability in some areas.

Table: Progressive for DUI

| Feature | Detail |

| Accident Forgiveness | Available |

| Ride-Share Coverage | Included |

| Claim Satisfaction | Below average |

The Secret to Getting the Best USA Car Insurance – For Young Drivers

Young drivers often face high premiums. GEICO provides some of the lowest rates for young drivers, along with discounts for good grades and safe driving.

Pros of GEICO:

- Affordable rates for young drivers.

- Discounts for academic excellence.

- Robust mobile app for claims.

Cons:

- Limited local agents.

- Does not offer gap insurance.

Table: GEICO for Young Drivers

| Feature | Detail |

| Discounts | Good grades, safe driving |

| Mobile App | Excellent |

| Local Agents | Limited |

The Secret to Getting the Best USA Car Insurance – For Senior Drivers

Senior drivers benefit from affordable rates with State Farm. With customer-focused policies and competitive premiums, it is a reliable choice for older drivers.

Table: State Farm for Senior Drivers

| Feature | Detail |

| Premiums | Competitive |

| Customer Policies | Senior-focused |

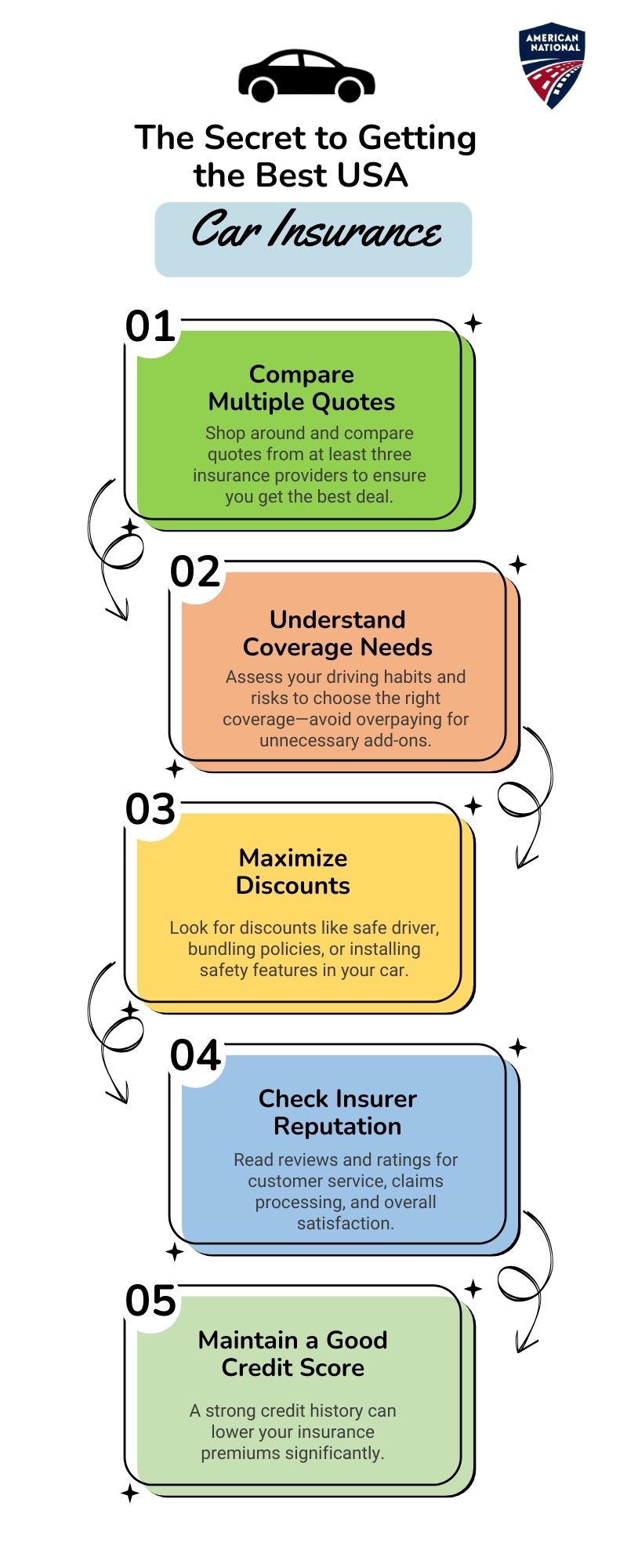

Additional Tips for Choosing the Right Car Insurance

- Assess Your Needs: Consider your driving record, age, and vehicle type.

- Compare Quotes: Always request quotes from multiple companies.

- Look for Discounts: Explore discounts for safe driving, bundling policies, or being a loyal customer.

- Read Reviews: Customer feedback can provide valuable insights.

- Check Coverage: Ensure the policy covers all your essential needs.

Table: Tips for Choosing Car Insurance

| Tip | Description |

| Assess Needs | Match policy to personal factors |

| Compare Quotes | Obtain quotes from various providers |

| Look for Discounts | Explore available discounts |

FAQs

What is the best car insurance for young drivers?

GEICO offers affordable rates and discounts for young drivers, making it a top choice.

Can I get car insurance with a DUI record?

Yes, Progressive provides options for individuals with DUI records, including accident forgiveness programs.

How do I choose the right car insurance provider?

Evaluate your needs, compare quotes, and read customer reviews to select the best provider.

Are there discounts for safe driving?

Yes, many companies like State Farm offer discounts for safe driving.

Thank you for reading! If you found this guide helpful, please share it with your friends and subscribe to our website notifications for more insights.

Melanie Lopez is a passionate content specialist at American National Car Insurance, dedicated to simplifying car insurance for every American driver. With years of industry expertise, she crafts informative and engaging articles to help users make confident insurance decisions.