Shopping for car insurance can be overwhelming. With so many options, policies, and questions, it’s easy to feel confused. But don’t worry—I’m here to help you navigate the process. As Melanie Lopez from Boston, I’ve built this guide on my website, American National Car Insurance, to make your journey smoother and more informed.

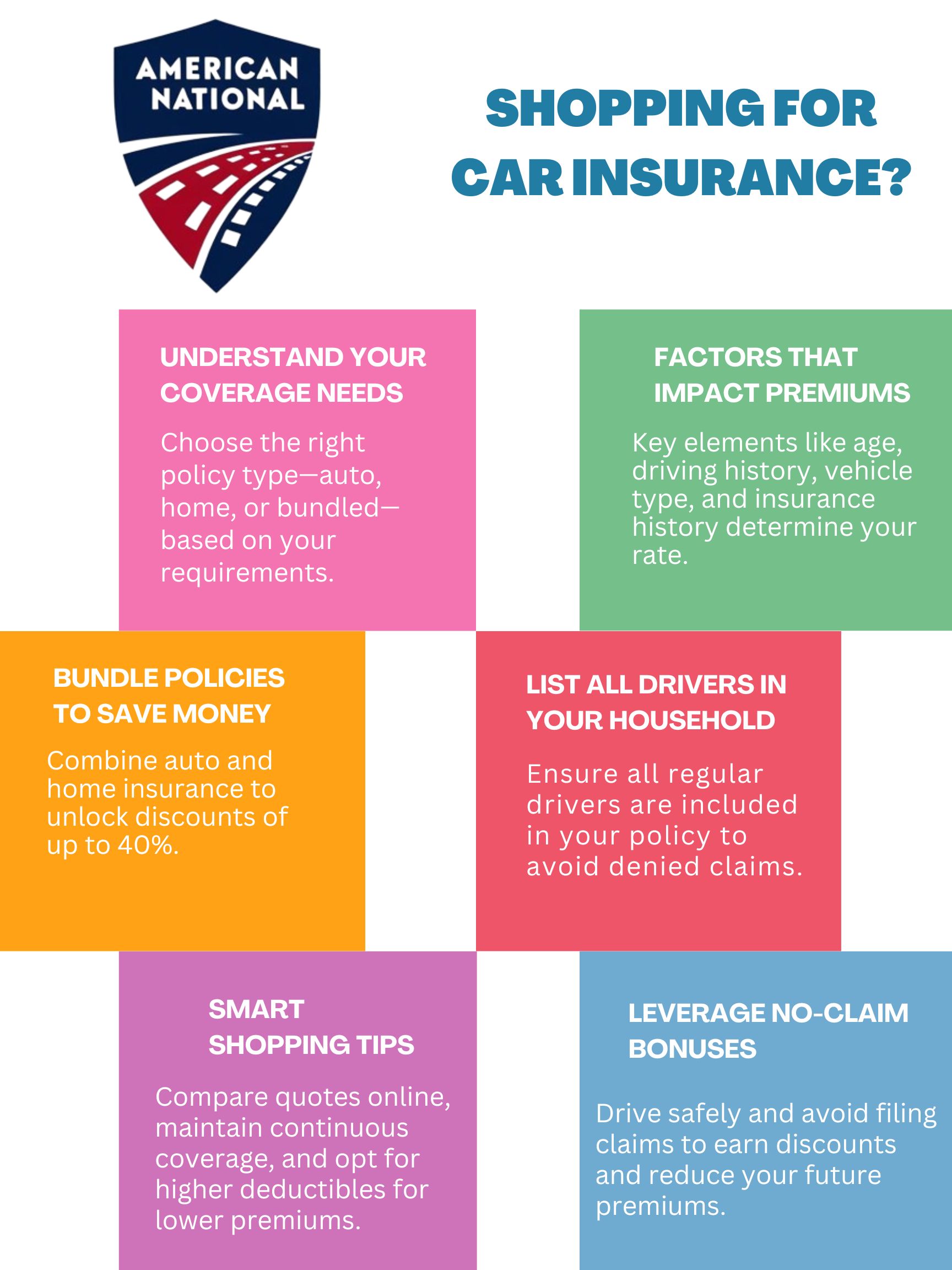

Car insurance isn’t just about price; it’s about getting the right coverage tailored to your needs. Below, we’ll discuss everything you need to know, from answering key questions to understanding what factors influence your premium.

What Type of Policy Do You Need?

The first question you’ll encounter while shopping for car insurance is: What type of policy do you need? This is the starting point for determining your coverage. Options include auto, home, umbrella, life, and even boat insurance.

If your primary focus is auto insurance, you’ll be asked detailed questions about your vehicle(s), such as the make, model, and year. For instance, I own a 2017 Honda Fit, and when I applied for coverage, I had to provide information about this car, including its registration and ownership details.

Key Considerations for Policy Types

| Type of Policy | Key Features |

| Auto Insurance | Covers damages, liability, and personal injury |

| Home Insurance | Protects your home and belongings |

| Umbrella Insurance | Offers additional liability coverage |

| Life Insurance | Provides financial security for beneficiaries |

What Vehicles Do You Own?

Another important question insurers will ask is: What vehicles are you insuring? The number of vehicles and their details—like age, usage, and ownership—impact your policy.

Most states allow separate policies for different vehicles, but combining them often saves money. For example, many insurers offer multi-car discounts. If you own multiple vehicles, bundling their policies might reduce your overall premium by 10–20%.

Factors Insurers Consider for Vehicle Coverage

| Vehicle Factor | Importance |

| Make and Model | Affects repair costs and theft risk |

| Year | Older cars may have lower premiums |

| Usage | Higher mileage increases risk |

How Many Drivers Are in Your Household?

Insurance companies often ask how many drivers live in your household. This is crucial because every licensed driver with access to your vehicle poses a potential risk. If someone in your household drives your car more than twice a year, they should be listed on your policy.

For instance, when my brother used my car regularly, I added him to my policy. Failing to list frequent drivers could lead to denied claims if they get into an accident.

Factors Insurers Consider for Drivers

| Driver Factor | Importance |

| Number of Drivers | More drivers increase risk |

| Age of Drivers | Younger drivers usually pay higher premiums |

| Driving History | Clean records lead to better rates |

Why Does Your Age Matter?

Age is one of the biggest factors in determining your insurance premium. Drivers under 25 are considered higher risk, while those between 40 and 60 are seen as the safest. Unfortunately, there’s no way to change your age, but you can take steps to improve your overall profile.

For example, I recommend defensive driving courses, which some insurers count as a discount factor.

Age and Premiums

| Age Range | Risk Level |

| Under 25 | High Risk |

| 25–50 | Medium Risk |

| 40–60 | Low Risk (Best Rates) |

Marital Status and Car Insurance

Although marital status isn’t as significant as other factors, it still plays a role. If you’re married, you can list your spouse as a secondary named insured, which might lower your premium.

For example, my husband’s excellent driving record helped reduce our combined premium when we bundled our policies. Additionally, if you’re in a domestic partnership, many insurers now allow you to list your partner as a secondary named insured.

Does Bundling Policies Save Money?

Bundling auto insurance with other policies, like home or renters insurance, can lead to significant discounts. Some companies offer up to 40% off your total premium if you bundle.

For instance, when I bundled my car and home insurance, I saved nearly $300 annually. However, it’s always worth checking individual rates as well, especially if you work with an independent agent who can compare both options for you.

Benefits of Bundling

| Benefit | Explanation |

| Cost Savings | Discounts up to 40% |

| Convenience | Single policy for multiple coverages |

| Enhanced Coverage | Tailored policies for your needs |

What About Prior Insurance?

Your insurance history is another critical factor. If you’ve had continuous coverage, you’re likely to receive better rates. On the other hand, lapses in coverage could lead to higher premiums.

For example, when I switched insurers, my previous history of continuous coverage helped me qualify for a loyalty discount.

Impact of Insurance History

| History Factor | Importance |

| Continuous Coverage | Leads to loyalty discounts |

| Lapses in Coverage | Higher premiums due to increased risk |

Tips for Shopping Smartly

To get the best deal on car insurance, it’s important to shop around and compare options. Here are my personal tips:

- Use online comparison tools like ThinkInsurance.com.

- Bundle your auto policy with other types of insurance.

- Maintain a clean driving record to qualify for better rates.

- Opt for higher deductibles if you want lower premiums.

- Work with independent agents for personalized recommendations.

FAQs

What factors affect car insurance premiums?

Factors like age, driving history, vehicle type, and location influence your premium.

Can bundling insurance policies save money?

Yes, bundling can lead to discounts of up to 40% on your overall premium.

Do I need to list all household drivers on my policy?

Yes, it’s essential to list anyone who drives your vehicle regularly.

How can I find the best car insurance company?

Research online reviews, compare quotes, and consult independent agents for tailored advice.

Final Thoughts

Shopping for car insurance doesn’t have to be complicated. By understanding the key factors and asking the right questions, you can find a policy that fits your needs and budget. I hope this guide helps you make an informed decision.

If you found this article helpful, please share it with your friends and subscribe to our website notifications for more updates.

Melanie Lopez is a passionate content specialist at American National Car Insurance, dedicated to simplifying car insurance for every American driver. With years of industry expertise, she crafts informative and engaging articles to help users make confident insurance decisions.