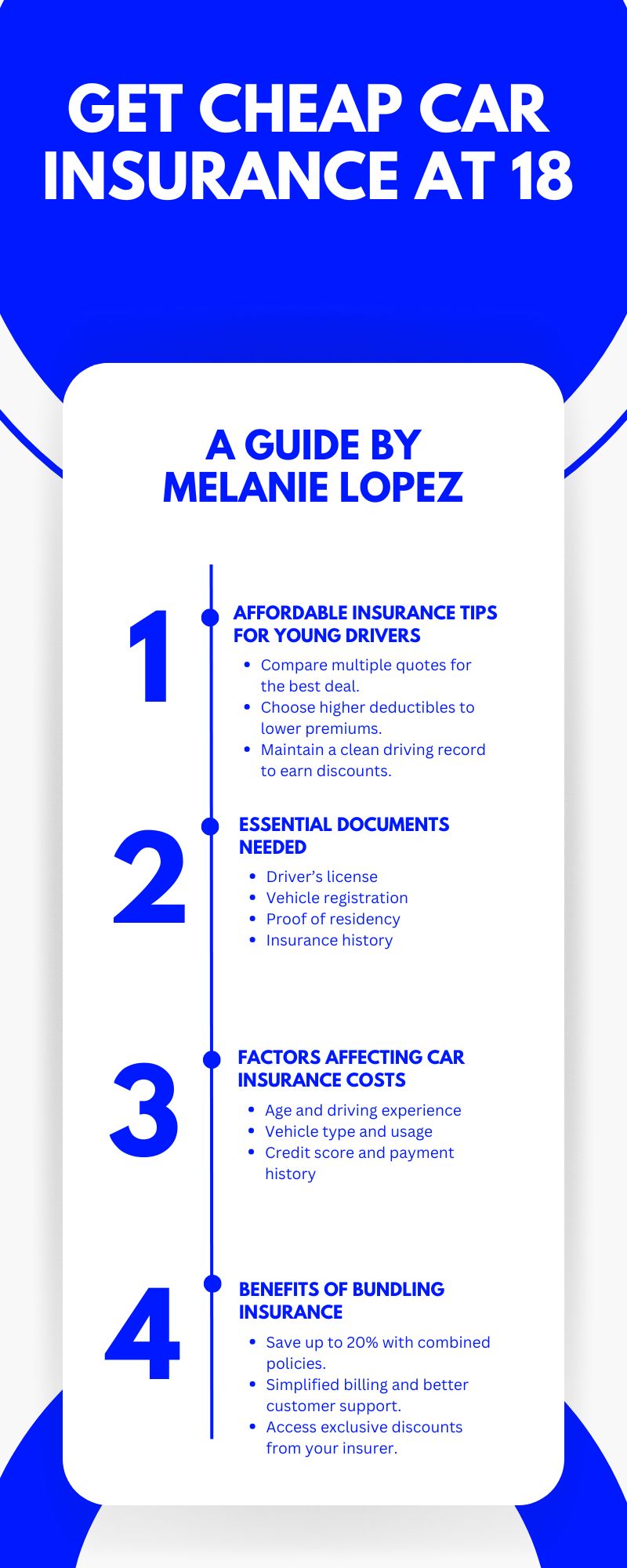

Finding cheap car insurance at 18 can feel overwhelming. As a young driver, insurance rates are typically high due to the perceived risks. But don’t worry – I, Melanie Lopez from Boston, am here to guide you through this journey. My new website, American National Car Insurance, is designed to provide you with actionable insights to help you make informed decisions about your insurance needs. Let’s dive into all the details you need to know to save money while staying protected.

How to Get Cheap Car Insurance at 18 – Understanding Why Rates Are High

At 18, you’re just starting out as a driver. Insurance companies see young drivers as high-risk due to their limited experience. Data shows that teenage drivers have a higher likelihood of being involved in accidents. According to the National Highway Traffic Safety Administration (NHTSA), over 2,000 fatal accidents in 2020 involved teen drivers. These statistics drive up the premiums for drivers in this age group.

Why Insurance Companies Charge Higher Rates

| Reason | Explanation |

| Lack of experience | Fewer years behind the wheel increase accident risks. |

| Higher accident statistics | Teens are more likely to make errors or take risks while driving. |

| Cost of repairs | Accidents involving teens often lead to higher repair costs. |

| Liability concerns | Young drivers are more likely to file claims for damages. |

However, there are effective strategies to lower your premiums, which I’ll cover in the next sections.

How to Get Cheap Car Insurance at 18 – Practical Ways to Save Money

Saving on car insurance isn’t impossible if you know the right steps. Here are some practical strategies:

Compare Insurance Quotes

One of the simplest ways to find affordable insurance is by shopping around. Different companies calculate premiums differently, so don’t settle for the first quote you receive. For example, when I helped my cousin find insurance, we compared quotes from five providers and saved over $300 annually.

| Provider | Monthly Premium | Discounts Available |

| Provider A | $150 | Student Discount |

| Provider B | $175 | Bundling Option |

| Provider C | $140 | Defensive Driving Course |

Use online tools or consult local agents to get multiple quotes.

Maintain Good Grades

Many insurance companies offer discounts to students with excellent academic performance. A GPA of 3.0 or higher can qualify you for a discount ranging from 5% to 20%. This “good student discount” is a great incentive to stay focused in school.

| Grade Level | Potential Discount |

| 3.0 – 3.5 GPA | 5% – 10% |

| Above 3.5 GPA | Up to 20% |

Take a Defensive Driving Course

Completing a defensive driving course shows insurance companies that you’re serious about safe driving. Some states even mandate insurance discounts for certified course completion. Check with your state’s DMV for approved programs.

Drive a Safe and Affordable Car

Choosing a car with high safety ratings and low repair costs can significantly lower your premiums. Insurance rates vary depending on the make and model of your car. For example, sedans are typically cheaper to insure than sports cars.

| Car Type | Monthly Premium |

| Sedan | $120 |

| SUV | $140 |

| Sports Car | $200 |

Stay on a Parent’s Policy

If possible, consider staying on your parent’s insurance policy. Family plans often come with discounts, and the combined coverage can reduce your individual costs.

| Policy Type | Cost per Month |

| Individual Policy | $180 |

| Family Plan | $120 |

How to Get Cheap Car Insurance at 18 – Discounts and Benefits to Look For

Insurance companies offer various discounts that can lower your premiums. Knowing which discounts you qualify for can save you a lot of money.

Common Discounts for Young Drivers

| Discount Type | Eligibility |

| Good Student Discount | Maintain a GPA of 3.0 or higher. |

| Low Mileage Discount | Drive fewer than 7,500 miles annually. |

| Safe Driver Discount | Avoid accidents and traffic violations. |

| Bundling Discount | Combine auto and home insurance. |

| Telematics Discount | Use a tracking device to prove safe driving. |

I recommend discussing these options with your insurer to maximize your savings.

How to Get Cheap Car Insurance at 18 – State-Specific Costs

Your location plays a significant role in determining your insurance costs. For instance, states like Michigan have higher premiums due to no-fault insurance laws, while states like Idaho offer more affordable rates.

| State | Average Monthly Cost |

| Michigan | $400 |

| California | $350 |

| Idaho | $150 |

| Texas | $300 |

Living in a state with lower insurance costs can save you hundreds annually.

How to Get Cheap Car Insurance at 18 – FAQs

What is the cheapest insurance company for 18-year-olds?

The cheapest company varies based on your location, driving record, and car. Companies like GEICO and State Farm often offer competitive rates for young drivers.

Can I get car insurance without a credit history?

Yes, but your premiums might be higher. Some insurers focus on driving records more than credit scores.

How can I prove I’m a safe driver?

Enroll in a defensive driving course and maintain a clean driving record with no accidents or traffic violations.

Does the type of car I drive really affect my insurance?

Absolutely. Cars with high safety ratings and low repair costs typically have lower premiums.

Final Thoughts

Securing cheap car insurance at 18 requires research, discipline, and smart decisions. By comparing quotes, taking advantage of discounts, and practicing safe driving, you can significantly reduce your premiums. Remember, staying informed is the key to saving money.

If you found this guide helpful, share it with your friends and subscribe to American National Car Insurance for more tips and updates. Let’s make affordable car insurance accessible for everyone.

Melanie Lopez is a passionate content specialist at American National Car Insurance, dedicated to simplifying car insurance for every American driver. With years of industry expertise, she crafts informative and engaging articles to help users make confident insurance decisions.