Understanding how much car insurance do you actually need can be confusing, especially with various coverage options and terms like liability bodily injury and uninsured motorist coverage.

This article will guide you in making informed decisions, saving money, and staying protected. Let’s break it down step by step.

What to Know About Deductibles and Premiums

When choosing auto insurance, the deductible and premium are often the first things people focus on.

The deductible is the amount you pay out of pocket before your insurance kicks in, while the premium is your monthly or yearly payment for the policy. Striking a balance between these two is essential.

For example, if you choose a high deductible, your premium will likely be lower. But remember, in case of an accident, you’ll need to cover the deductible amount upfront.

It’s worth considering your financial situation to decide on the right balance. Many people find that a $500 or $1,000 deductible works well for balancing cost and protection.

Deductibles and Premiums Comparison

| Deductible Amount | Premium Cost | Best For |

| $500 | Higher | Frequent drivers |

| $1,000 | Moderate | Occasional drivers |

| $2,000 | Lower | Risk-tolerant individuals |

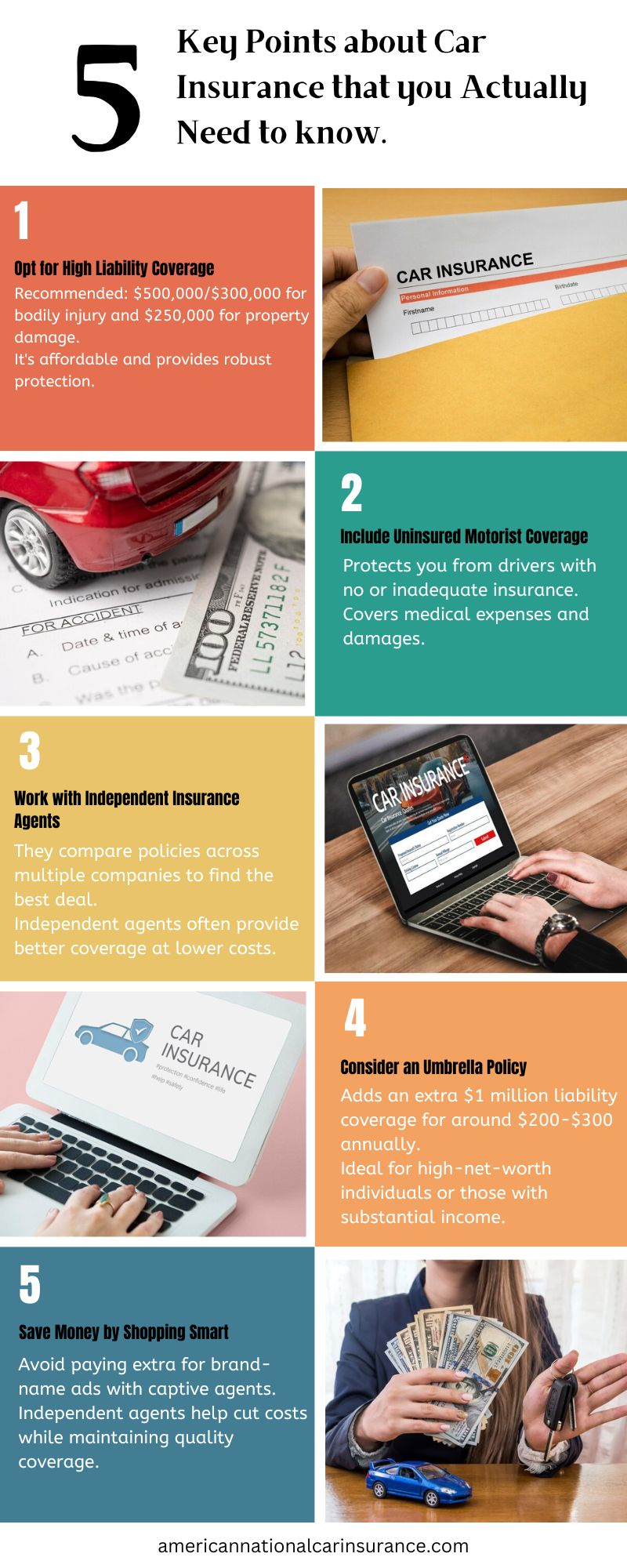

High Liability Coverage – Why It’s a Good Investment

Liability coverage is cheap but vital in auto insurance. It protects you financially if you’re at fault for an accident causing injury or damage.

Experts recommend carrying high liability limits, such as $500,000/$300,000 or $500,000/$250,000, depending on the insurer.

Accidents can strike suddenly, resulting in serious injuries and costly damages. When they do, inadequate coverage limits can leave you high and dry. It’s crucial to secure sufficient insurance to safeguard your interests. Don’t let a low policy limit trap you in a bind!

For example, medical and legal bills can soar to hundreds of thousands. By choosing higher limits, you protect yourself from these financial burdens.

Table: Liability Coverage Recommendations

| Coverage Type | Suggested Amount | Reason |

| Bodily Injury (Per Person) | $500,000 | Covers medical expenses |

| Bodily Injury (Per Accident) | $300,000 | Handles multiple claims |

| Property Damage | $250,000 | Covers high-value assets |

Uninsured and Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage protects you in accidents caused by underinsured drivers. It’s vital, especially in states with many uninsured drivers.

For instance, if an uninsured driver hits you and your medical bills reach $50,000, this coverage protects you. It ensures you won’t bear those costs alone. It’s a crucial safety net for every driver, offering peace of mind in uncertain situations.

Uninsured/Underinsured Motorist Coverage

| Coverage Type | Benefits |

| Uninsured Motorist Injury | Covers medical costs from uninsured drivers |

| Underinsured Motorist Injury | Supplements insufficient coverage by other drivers |

The Role of Independent Insurance Agents

When buying car insurance, you’ll meet two types of agents: captive and independent. Captive agents work for one company, like State Farm or Nationwide. They can only sell that company’s policies.

Independent agents, on the other hand, represent multiple insurers. They can compare rates and coverage for you.

Picking an independent agent often leads to better deals and wider coverage. For example, Zander Insurance offers policies that fit your needs without the high costs of captive agencies. Moreover, independent agents aim to find the best deal, as their reputation relies on it.

Captive vs. Independent Agents

| Feature | Captive Agent | Independent Agent |

| Number of Companies | One | Multiple |

| Policy Flexibility | Limited | High |

| Cost Effectiveness | Moderate | Better deals |

Umbrella Policies – Extra Protection for High Net Worth Individuals

If your net worth is over $500,000 or you earn a lot, consider adding an umbrella policy to your auto insurance. This policy offers extra liability coverage beyond your standard auto and home insurance limits.

For instance, you can add an extra $1 million in liability coverage for as little as $200-$300 per year. This ensures that even in catastrophic accidents, your financial assets remain protected.

Table: Umbrella Policy Features

| Coverage Type | Cost (Annually) | Protection Amount |

| Auto Liability | $200-$300 | $1 Million |

| Homeowners Liability | $200-$300 | $1 Million |

Save Money by Shopping Smart

Many people overpay for auto insurance because they don’t shop around. Independent agents can help you compare policies from different insurers, ensuring you get the best deal.

Keep in mind that big-name insurers often have higher premiums due to advertising expenses. Independent agents cut through this by offering policies without unnecessary add-ons.

Elizabeth from Boston switched from a captive agent to an independent one. She now saves $400 a year on her car insurance and has better coverage. Smart shopping really pays off.

Cost Comparison – Captive vs. Independent Policies

| Policy Type | Captive Agent Premium | Independent Agent Premium |

| Full Coverage | $1,200 | $800 |

| Liability Only | $600 | $450 |

FAQs: How Much Car Insurance Do You Actually Need?

What is the ideal liability coverage amount?

The suggested liability coverage is $500,000 for bodily injury per person, $300,000 per accident, and $250,000 for property damage. This coverage offers protection in severe accidents.

Should I choose a high deductible?

A higher deductible reduces your premium but increases out-of-pocket costs during claims. Choose based on your financial comfort.

Is uninsured motorist coverage necessary?

Absolutely, it shields you from the financial pitfalls of underinsured drivers. Enjoy peace of mind knowing you’re protected from unexpected expenses. With this cover, crucial financial security is just a heartbeat away.

How do I find the best auto insurance deal?

Work with an independent agent. They can compare policies from multiple companies and give tailored recommendations.

My Final Thoughts

Auto insurance is not just a legal requirement – it’s a critical part of financial planning. By understanding your needs and exploring options, you can get the best coverage at an affordable price.

I’m Melanie Lopez. I suggest you consult an independent agent to maximise benefits. Also, please share this article and subscribe for more tips on saving money and making smart insurance choices

Melanie Lopez is a passionate content specialist at American National Car Insurance, dedicated to simplifying car insurance for every American driver. With years of industry expertise, she crafts informative and engaging articles to help users make confident insurance decisions.