Hi, I’m Melanie Lopez from Boston. I’m excited to share insights on my website, https://americannationalcarinsurance.com. Finding affordable car insurance for teens in 2025 can be tough. However, with the right advice you can save time and money.

Let’s plunge into the particulars and navigate clever ways to snag affordable coverage for your teen drivers. Safety on the road is our priority, ensuring peace of mind for everyone involved.

Cheap Car Insurance for Teens 2025 – Why Teens Pay Higher Premiums

Teen drivers are more likely to have accidents than older ones. This makes them a higher risk for insurers, leading to higher premiums. By understanding what affects these rates, you can find ways to lower your costs.

Factors Influencing Teen Insurance Rates:

| Factor | Explanation |

| Lack of Experience | Teens typically have limited driving history, which raises their risk level. |

| Accident Rates | Teens are statistically more prone to accidents, making them costlier to insure. |

| Vehicle Type | Insuring high-performance or luxury vehicles is more expensive for teens. |

| Location | Premiums vary based on local accident statistics and state regulations. |

| Gender | Male teen drivers often pay higher premiums than female teens. |

If you’re looking for insurance for your teen, consider these factors. They explain why premiums may vary and how to reduce them.

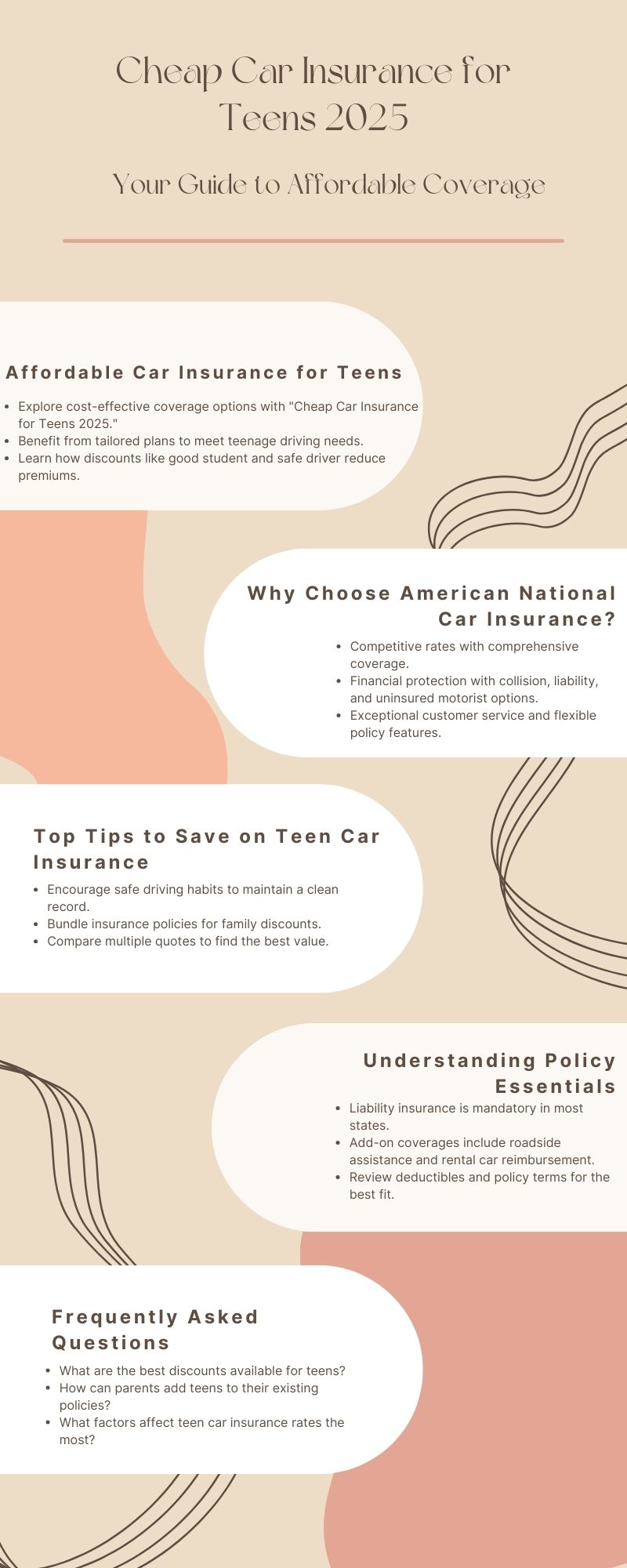

Cheap Car Insurance for Teens 2025 – How to Reduce Insurance Costs

Lowering insurance costs for your teen doesn’t have to be complicated. Here are some actionable strategies to get cheaper rates

- Enroll in Defensive Driving Courses: Many insurers offer discounts if teens complete approved defensive driving programs.

- Choose a Safe Vehicle: Opt for a car with high safety ratings and advanced features such as airbags and anti-lock brakes.

- Bundle Policies: If you already have car insurance, adding your teen to your policy can often result in discounts.

- Maintain Good Grades: Many insurers offer discounts for students with a GPA of 3.0 or higher.

- Limit Driving Miles: Policies like usage-based insurance reward teens who drive less frequently.

Cost-Saving Options at a Glance:

| Strategy | Potential Savings (%) |

| Defensive Driving Courses | 5-15% |

| Good Student Discounts | 10-25% |

| Multi-Vehicle Policies | Up to 20% |

| Low-Mileage Usage Plans | Varies based on driving habits |

By exploring these options you can significantly lower the financial burden of insuring your teen driver.

Cheap Car Insurance for Teens 2025 – Best Companies for Teen Drivers

Looking for affordable insurance for teens? Some companies offer great discounts and flexible policies. Based on customer reviews and industry trends, here are the top providers

Top Insurance Companies for Teens:

| Company Name | Key Benefits |

| American National Car Insurance | Offers competitive rates for teens with good driving records. |

| GEICO | Provides discounts for good grades and safe driving programs. |

| State Farm | Known for its Steer Clear program designed for young drivers. |

| Allstate | Offers accident forgiveness and multiple bundling options. |

| Progressive | Provides telematics-based discounts for safe driving habits. |

For more personalized advice, reach out to these companies and compare quotes. A little research goes a long way in finding the best fit for your family.

Cheap Car Insurance for Teens 2025 – Importance of American National Car Insurance

American National Car Insurance shines for its affordable, comprehensive coverage. They know the challenges parents face with insuring teen drivers. Here are some key points:

- Customizable Policies: Tailor coverage to suit your teen’s driving habits.

- Accident Forgiveness: Protect yourself from rate hikes after a first accident.

- Family Discounts: Save more by bundling multiple family members under one policy.

Why Choose American National Car Insurance:

| Benefit | Description |

| Flexible Coverage | Adjust deductibles and coverage limits to meet specific needs. |

| Competitive Pricing | Offers discounts for safe driving and bundling policies. |

| Excellent Support | Provides 24/7 assistance for claims and policy questions. |

By choosing American National Car Insurance, you pick a provider that is cheap and high-quality.

Cheap Car Insurance for Teens 2025 – What to Do After an Accident

Accidents can be stressful, especially for inexperienced teen drivers. Knowing how to handle the situation can save time, money, and stress.

Steps to Take After an Accident:

- Ensure Safety: Move to a safe area and check for injuries

- Document Details: Collect the other driver’s insurance information, take photos and note the accident’s location

- File a Claim: Collect the other driver’s insurance info. Take photos and note the accident’s location. Then, contact your insurer and provide all details.

- Learn from the Experience: Discuss safe driving practices with your teen to prevent future incidents

Accident Checklist:

| Step | Action |

| Move to Safety | Ensure the accident scene is secure and call emergency services if needed. |

| Gather Evidence | Take pictures of damages and collect witness statements if possible. |

| Contact Insurer | Notify your insurance company and follow their claim procedure. |

| Stay Calm | Remind your teen to remain calm and cooperative throughout the process. |

Teaching your teenager how to respond well to accidents is a crucial part of being a responsible driver.

If you get into an accident, there are certain things you need to do right away. First, make sure everyone involved is okay, then move the vehicle to a safe place if it’s blocking traffic. Swap info with the other party, like names, phone numbers, and registration details. Take note of the accident scene, including any damage to the vehicles or other property.

If someone is injured or it’s a major accident, call the police right away. Otherwise, it’s a good idea to file a police report anyway, as it can help with insurance claims.

It’s also a good idea to teach your teen about the importance of staying calm and not admitting fault, even if they think it’s their mistake. And remind them to never leave the scene of an accident without exchanging info and making sure everyone is safe.

FAQs About Cheap Car Insurance for Teens 2025

What is the cheapest car insurance for teens in 2025?

The cheapest insurance varies by location, driving history, and discounts. Companies like GEICO, Progressive, and American National often offer competitive rates for teens.

How can I lower my teen’s insurance premiums?

You can lower premiums by:

enrolling them in defensive driving courses,

keeping good grades,

choosing a safe vehicle, and

bundling policies.

Does adding a teen to my policy save money?

Yes, adding your teen to an existing policy is usually cheaper than buying a separate one.

What should I do if my teen has an accident?

Ensure their safety, document the incident, and contact your insurer to file a claim. Use this experience to reinforce safe driving habits.

Final Thoughts

I hope this guide helps you find cheap car insurance for teens in 2025. Choosing the right insurer, looking for discounts, and teaching safe driving can make a big difference. If you found this useful, please share it and subscribe to my site for more updates.

Melanie Lopez is a passionate content specialist at American National Car Insurance, dedicated to simplifying car insurance for every American driver. With years of industry expertise, she crafts informative and engaging articles to help users make confident insurance decisions.