Searching for affordable car insurance in Connecticut might seem tough. However, with proper advice, you can get good coverage at a low price. This guide aims to help Connecticut drivers understand car insurance, save money, and meet their coverage needs.

What Is Car Insurance, and Why Is It Necessary in Connecticut?

Car insurance is a deal between a car owner and an insurer. It protects against accidents, theft, and unexpected events. In Connecticut, it’s required. This ensures drivers can pay for damages or injuries in a crash.

Key Reasons to Have Car Insurance in Connecticut:

- Legal Requirement: Connecticut law mandates liability insurance.

- Financial Protection: Covers repair costs, medical bills, and third-party claims.

- Peace of Mind: Provides security against unexpected expenses.

| Minimum Coverage Requirements in Connecticut | Details |

| Bodily Injury Liability | $25,000 per person; $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Uninsured/Underinsured Motorist Coverage | Equal to liability coverage limits |

Factors Affecting Car Insurance Rates in Connecticut

Understanding what influences your premium can help you find cheap car insurance in Connecticut. Here are the main factors

1. Age and Driving Experience:

- Young or inexperienced drivers often face higher premiums.

2. Driving Record:

- Clean records lead to lower rates, while accidents and violations increase costs.

3. Vehicle Type:

- Luxury or sports cars cost more to insure than standard vehicles.

4. Location:

- Urban areas typically have higher rates due to increased traffic and theft risks.

5. Coverage Type:

- Comprehensive coverage costs more than minimum liability coverage.

| Factor | How It Affects Premium |

| Age | Younger drivers pay more |

| Driving Record | Accidents increase rates |

| Vehicle Type | High-value cars cost more |

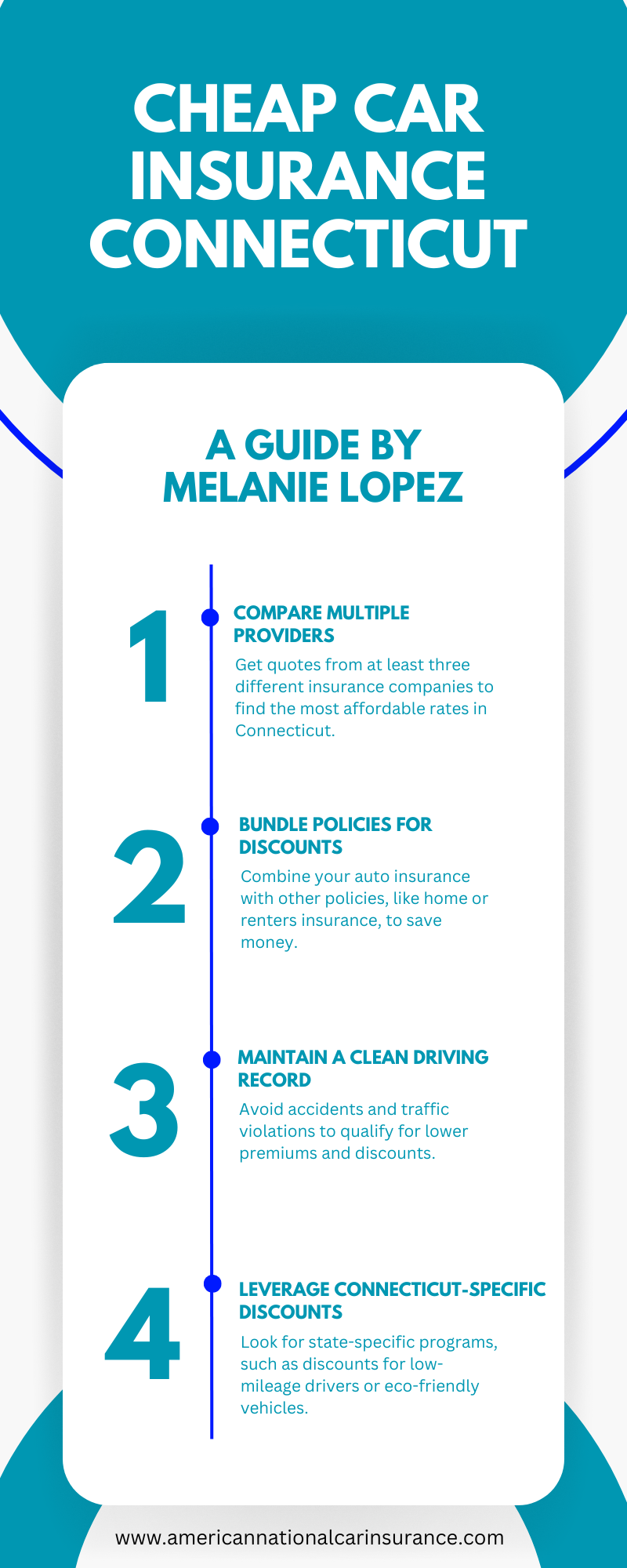

Tips to Find Cheap Car Insurance in Connecticut

To get affordable car insurance in Connecticut, follow these practical tips:

1. Compare Multiple Quotes:

- Use online comparison tools to find the best rates.

- Reach out to local insurance agents for customized quotes.

2. Opt for Higher Deductibles:

- Increasing your deductible reduces your monthly premium.

3. Bundle Policies:

- Combine auto insurance with home or renter’s insurance for discounts.

4. Maintain a Clean Driving Record:

- Avoid traffic violations and accidents.

5. Ask About Discounts:

- Look for discounts for safe driving, good grades (for students), or anti-theft devices.

| Tip | Benefit |

| Compare Quotes | Find the lowest premium |

| Higher Deductibles | Lower monthly payments |

| Bundle Policies | Additional discounts |

Top Companies Offering Cheap Car Insurance in Connecticut

1. State Farm:

- Known for excellent customer service and competitive rates

2. Geico:

- Offers affordable policies and various discounts

3. Progressive:

- Provides unique options like usage-based insurance

4. Allstate:

- Offers personalized coverage options and loyalty discounts

5. USAA:

- Ideal for military families, offering low rates and premium services.

| Company | Strengths |

| State Farm | Best for customer service |

| Geico | Most affordable policies |

| Progressive | Usage-based options |

| Allstate | Loyalty discounts |

| USAA | Best for military personnel |

FAQs About cheap car insurance connecticut

1. What is the average cost of car insurance in Connecticut?

The average annual premium in Connecticut is around $1,300, but rates vary based on individual factors

2. Can I get car insurance with a bad driving record?

Yes, but it may cost more. Consider insurers specializing in high-risk drivers.

3. Are there penalties for driving without insurance in Connecticut?

Yes, penalties include fines, license suspension, and vehicle impoundment.

4. What discounts are available for Connecticut drivers?

Discounts include safe driving, multi-policy, good student, and anti-theft device discounts.

5. How can I lower my car insurance premium?

Maintain a clean driving record, bundle policies, and increase deductibles.

Important Links for Connecticut Drivers

| Resource | Link |

| Connecticut DMV | Visit Site |

| Insurance Comparison Tool | Visit Site |

| State Farm Connecticut Office | Visit Site |

Conclusion

Finding cheap car insurance in Connecticut needs research and smart choices. First, understand your options. Then, compare quotes and use discounts. This way, you get affordable coverage. Share this guide and subscribe for more money-saving tips

Melanie Lopez is a passionate content specialist at American National Car Insurance, dedicated to simplifying car insurance for every American driver. With years of industry expertise, she crafts informative and engaging articles to help users make confident insurance decisions.