Hello! I’m Melanie Lopez from Boston, and I’m excited to introduce you to my new website, https://americannationalcarinsurance.com. This platform is dedicated to providing in-depth information about American national car insurance and how young adults in Florida can find the best coverage. Let’s dive into everything you need to know about finding the best car insurance in Florida for young adults and why it matters.

Best car insurance in Florida for young adults – Why is it important?

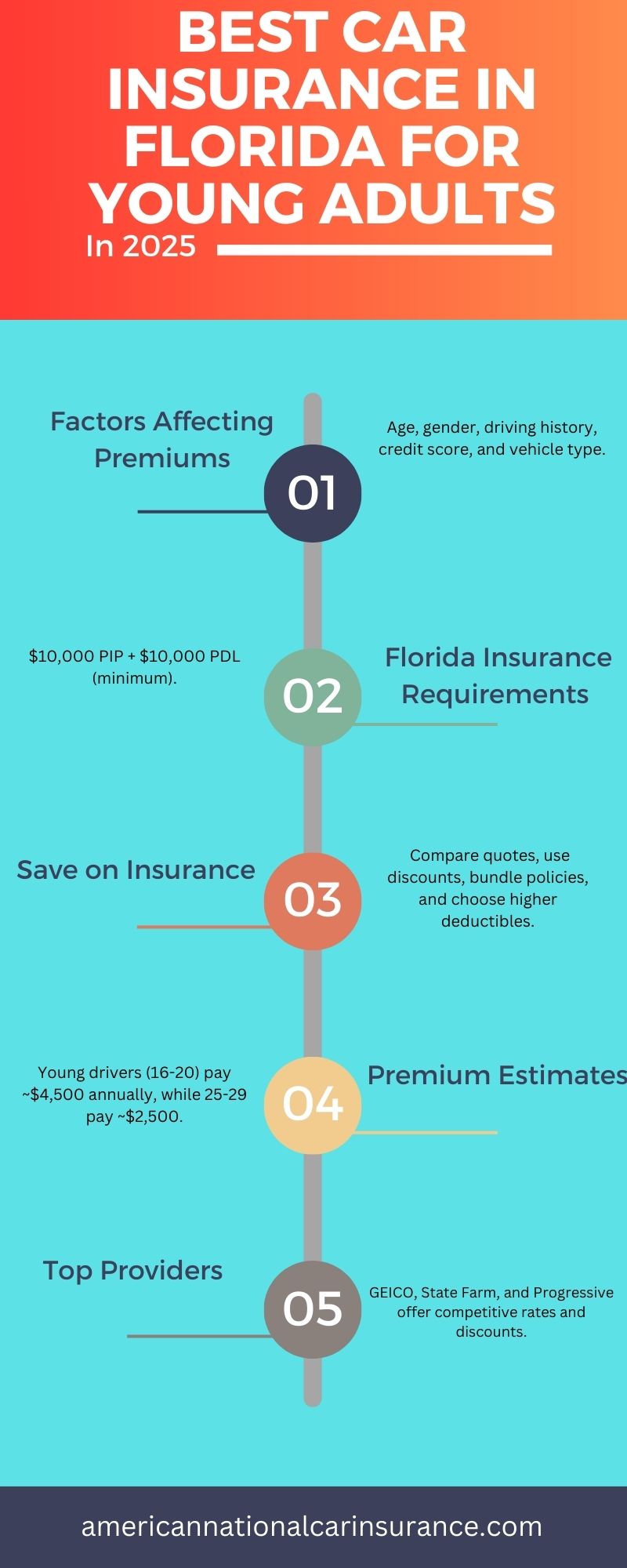

Finding affordable car insurance in Florida can be overwhelming, especially for young adults. Many factors influence premiums, such as age, driving history, and location. For young drivers, rates are typically higher due to perceived risks. That’s why it’s essential to understand your options and choose wisely.

Key Highlights for Young Adults:

- Young adults under 25 often pay higher premiums due to limited driving experience.

- Florida laws require drivers to have minimum coverage, including $10,000 for Personal Injury Protection (PIP) and $10,000 for Property Damage Liability (PDL).

- Insurers offer discounts for students, safe driving, and bundling policies.

Table of Florida’s Minimum Insurance Requirements:

| Coverage Type | Minimum Amount |

| Personal Injury Protection (PIP) | $10,000 |

| Property Damage Liability (PDL) | $10,000 |

| Bodily Injury Liability (Optional but Recommended) | Varies by provider |

Understanding these basics will help you make informed decisions about coverage options.

Best car insurance in Florida for young adults – Factors affecting rates

Several factors influence the cost of car insurance in Florida for young adults. Being aware of these can help you save money while ensuring you’re adequately covered.

Factors That Determine Premiums:

- Age and Gender – Young males often face higher premiums compared to females.

- Driving History – Clean records lead to lower rates, while accidents or tickets increase costs.

- Type of Car – Sports cars or luxury vehicles cost more to insure.

- Credit Score – In Florida, insurers consider your credit score when calculating premiums.

- Location – Urban areas like Miami or Orlando typically have higher rates than rural locations.

Table of Premium Estimates by Age Group:

| Age Group | Average Annual Premium |

| 16-20 | $4,500 |

| 21-24 | $3,200 |

| 25-29 | $2,500 |

If you’re a young adult, focusing on improving your credit score and maintaining a clean driving record can significantly lower your costs.

Best car insurance in Florida for young adults – How to find affordable options

Finding affordable insurance doesn’t mean compromising on quality. Many insurers cater to young drivers with discounts and flexible plans. Here are some tips:

Tips for Finding Cheap Auto Insurance Online:

- Compare Quotes – Use online tools to get multiple quotes from different companies.

- Look for Discounts – Many providers offer student discounts or savings for safe driving.

- Choose Higher Deductibles – Opting for a higher deductible can lower your monthly premium.

- Bundle Policies – Combine auto and renters insurance to save more.

- Telematics Programs – Enroll in usage-based programs that monitor driving habits and reward safe behavior.

Table of Discounts Offered by Top Providers:

| Provider | Discount Options |

| GEICO | Student discounts, safe driving |

| State Farm | Good grades, multi-policy |

| Progressive | Telematics, accident-free |

These strategies can help you find a policy that fits your budget and lifestyle.

Best car insurance in Florida for young adults – Top providers to consider

When it comes to car insurance, not all providers are created equal. Some stand out for their affordability and excellent service tailored to young drivers.

Recommended Providers:

- GEICO – Known for competitive rates and excellent customer service.

- State Farm – Offers student discounts and a robust mobile app for easy management.

- Progressive – Provides flexible plans and telematics options for young drivers.

Table of Comparison for Top Providers:

| Provider | Average Annual Premium | Key Features |

| GEICO | $1,200 | Mobile app, great discounts |

| State Farm | $1,400 | Student benefits, easy claims |

| Progressive | $1,350 | Flexible coverage options |

Researching these companies and reading reviews can help you choose the best fit for your needs.

Best car insurance in Florida for young adults – How American national car insurance can help

At American national car insurance, we focus on providing personalized plans that cater to young adults. Our goal is to make the process simple and affordable.

Why Choose American National Car Insurance

- Affordable Rates – Competitive pricing tailored to young drivers

- Customizable Plans – Choose the coverage you need without overpaying

- Excellent Support – Our team is here to guide you every step of the way

Table of Benefits with American National

| Feature | Benefit |

| Custom Plans | Tailored to individual needs |

| Affordable Premiums | Competitive pricing |

| 24/7 Customer Support | Assistance when you need it |

We aim to provide the best coverage options so you can drive with peace of mind.

FAQs

What is the minimum car insurance required in Florida?

Florida requires drivers to have $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL).

Can young drivers get discounts on car insurance?

Yes, many providers offer discounts for students, safe driving, and bundling policies.

How can I lower my car insurance premiums?

You can lower premiums by maintaining a clean driving record, improving your credit score, and opting for higher deductibles.

Why are premiums higher for young adults?

Young adults are considered high-risk due to their limited driving experience, leading to higher premiums.

If you found this guide helpful, please share it with friends and family. Don’t forget to subscribe to our website notifications for more tips and updates!

By following these steps and exploring your options, you can find the best car insurance in Florida for young adults that meets your needs and budget. Feel free to contact me, Melanie Lopez, for more personalized advice or visit https://americannationalcarinsurance.com.

Melanie Lopez is a passionate content specialist at American National Car Insurance, dedicated to simplifying car insurance for every American driver. With years of industry expertise, she crafts informative and engaging articles to help users make confident insurance decisions.